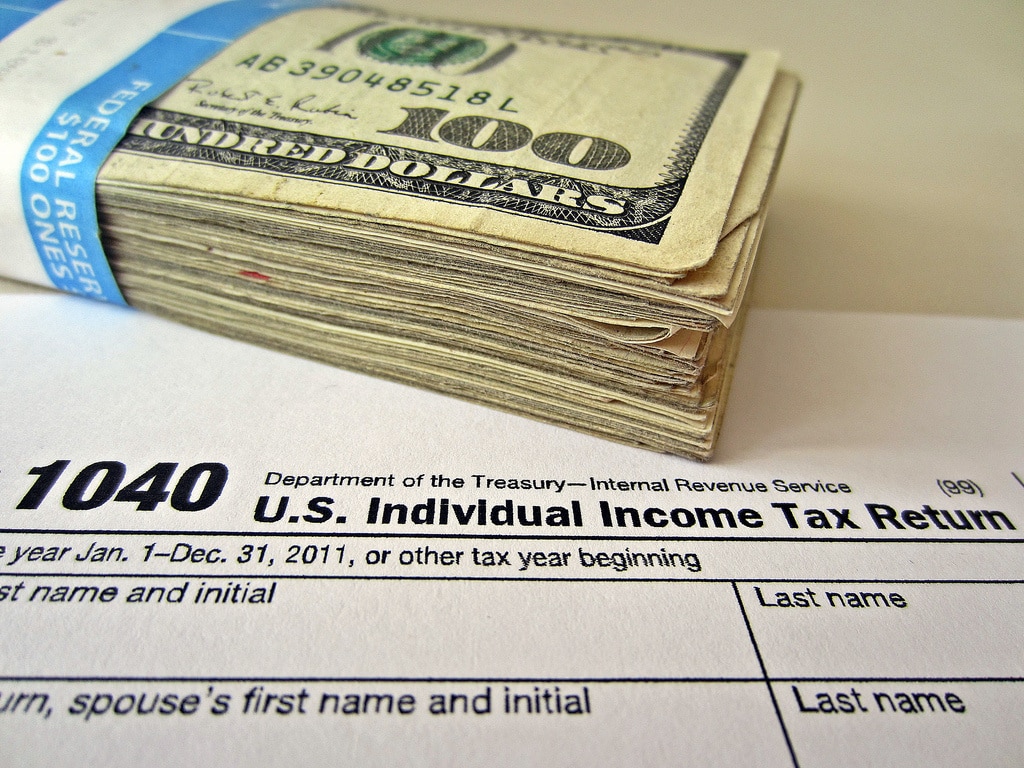

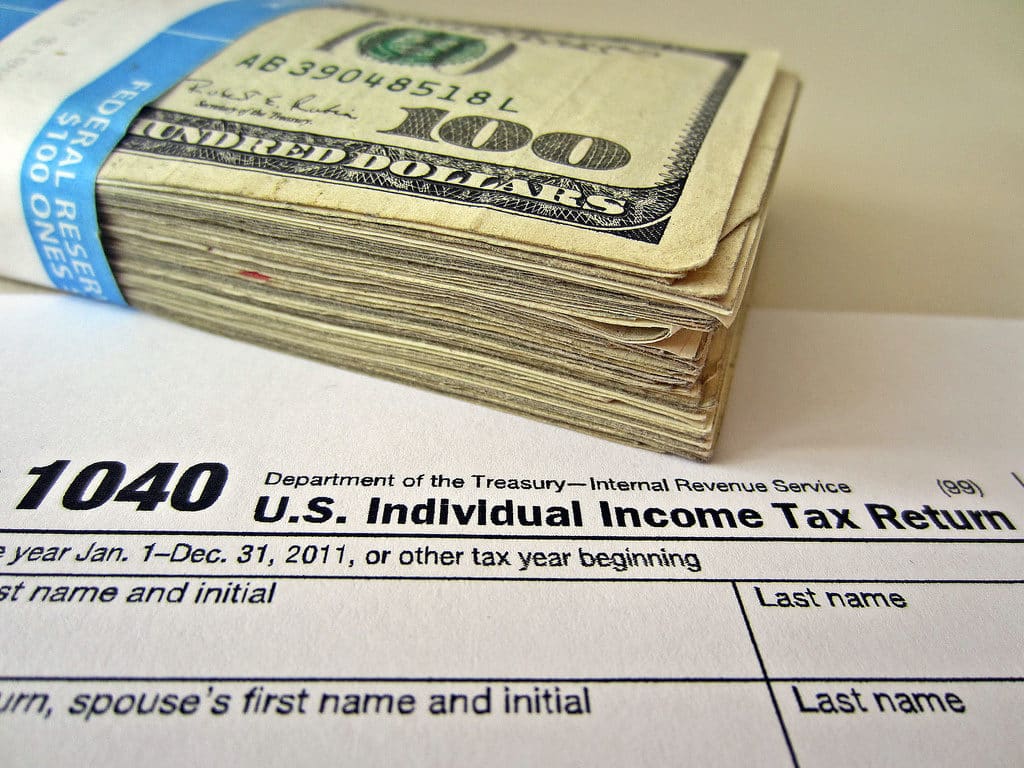

The Best Tax Reform Since The 1980’s Passed The Senate At The 11th Hour …

The U.S. Senate passed legislation very early on Saturday morning to overhaul and reform tax code.

What are the details?

In a 51-49 ruling, senators voted to pass the bill after many days of debate over the Republican tax bill.

The only Republican to vote against the bill was Sen. Bob Corker (R-Tenn.), who voted “no” due to concerns about the tax plan’s impact on the national deficit.

No Democratic senators supported the tax legislation, and quickly exited the chamber after casting their “no” votes.

GOP senators, who remained on the floor of the Senate until well after midnight, broke out into applause after Vice President Mike Pence — who presided over the final passage vote — announced that the bill had passed.

Senate Majority Leader Mitch McConnell (R-Ky.), during a Saturday press conference held after the vote, said, “This is a great day for the country.”

“We have an opportunity now to make America more competitive, to keep jobs from being shipped off shore and to provide substantial relief for the middle class,” he added.

After the vote, President Donald Trump on Twitter wrote;

“We are one step closer to delivering MASSIVE tax cuts for working families across America. Special thanks to @SenateMajLdr Mitch McConnell and Chairman @SenOrrinHatch for shepherding our bill through the Senate. Look forward to signing a final bill before Christmas!”

The Democratic Leftists are pushing the narrative that this tax plan only benefits the rich and wealthy, however that is far from the truth.

Fox News reports:

Low-income households: The plan doubles the standard deduction, which reduces the amount of taxed income, to $12,000 for individuals and $24,000 for married couples, making low-income taxpayers a winner, Steve Odland, CEO of the Committee for Economic Development, told Fox News.

The tax plan helps the rich, yes but also the poor, not to mention it will majorly stimulate the economy like we haven’t seen since the 80s.